By Brad Powell

I’m pleased to announce the debut of a new product for credit unions today: Redboard.

What is Redboard? The short answer is that it’s credit union compliance software, aimed at helping CUs better respond to regulatory examinations. (For a longer answer, read more here. And feel free to follow up with questions and feedback.)

Why did we create Redboard? That answer has two parts.

By Brad Powell

A little more than a year ago, I wrote a post that recappped key mobile banking trends for 2015. As 2017 kicks off, several of those trends are continuing to grow in importance, with one in particular standing out: The need for banks to learn from their technology sector counterparts when it comes to customer experience.

Technology has made our lives easier in many ways, of course, but there’s no denying it also has made things more complex. The overall “customer experience” of modern life can be taxing.

Think about the number of passwords you manage. Your bulging email inbox (according to one report, the average office worker receives 121 work emails per day). The fact that it’s so easy for others to contact you, sell to you, and generally insert themselves into your life.

That’s why more and more technology companies are embracing simplicity when it comes to customer experience. It’s an approach banks and credit unions would be smart to mimic.

By Brad Powell

Those of us who work for and with banks and credit unions have a natural curiosity about the generation known as “millennials.”

As we try to understand more about them, we read (and sometimes make) generalizations. And that carries risk.

For instance, how many times in the past few years have you read an article claiming that millennials (the youngest generation of workers right now) want more “organic feedback” at their jobs? That’s probably true, but you can find Baby Boomers, Silent Generation members, and Gen X’ers who also want and value feedback.

By Brad Powell

By Brad PowellIn the banking and financial service space, biometric authentication is quickly becoming the principal form of mobile authentication. Instead of requiring a password, more and more apps use physical or behavioral characteristics to allow customers to access and manage their money.

Your first response might be: “I already knew that. The big banks have been doing this for a few years now!” Indeed. Biometrics have been around for more than a year at some larger providers, but the rate of change is fairly rapid.

Before we address what’s next, let’s quickly summarize where biometric authentication has been.

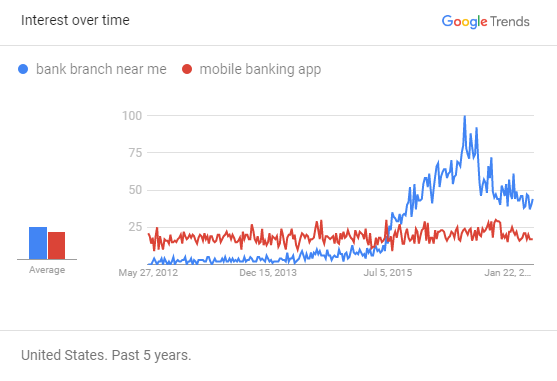

Out of curiosity, I compared two search terms on Google Trends recently: “mobile banking app” and “bank branch near me.”

It’s been widely reported that banking on mobile is overtaking branch visits in popularity. So trends in search should reflect that, right? Here’s what Google Trends showed for the past five years:

By Brad Powell

When Facebook announced it was opening its Messenger platform for third-party chatbots in April, a flood of technology and business coverage followed, hypothesizing about what the move could mean for a variety of industries.

Banking was not immune – a Google News search on "banking and bots" continues to turn up a long list of recent articles and blog posts about artificial intelligence-powered chatbots and their potential uses for banks, credit unions and other branches of the financial industry.

Often opening with the detail that Bank of America is planning to develop a bot to interact with customers in Facebook’s mobile messaging app, many of these articles sound similar notes. But a few outlets made points that were more original and intriguing. I wanted to highlight those in this post and add a couple ideas of my own regarding banking and bots.

But first, it’s worth going over the points that most of these articles have in common – the material that makes up the conventional wisdom on the topic.

By Brad Powell

One credit union had a significant and very successful business in the credit card space. But the credit union had a problem: Its process for taking credit card applications was complex.

There was an array of different systems: one for member information, another one for making and communicating decisions, one for taking applications online, and another one for taking applications through branches and telephone contact centers. There were a lot of moving parts.

The credit union originally sought to make its application process simpler, from a system perspective. Simpler systems are easier to maintain, to improve, and to keep up with compliance. And they wanted to achieve some staff efficiencies.

By Brad Powell

There are many problems you can solve with electronic signature applications. Some of the most common reasons for implementation are reducing risk, decreasing cost, and offering a better and more convenient product to members at your credit union. And we all know that the next generation of members expects to be able to electronically sign financial instruments on their devices of choice.

Despite those benefits, many credit unions and banks stall on electronic signature applications. The reason is adoption. They fear that once electronic signatures are implemented, the member will still revert to paper.

The fear is not baseless. Getting adoption is not easy. But you can learn from what one credit union has done to achieve more than 90 percent adoption. Though we would love to take credit for the results, success requires a collaborative effort.

By Brad Powell

You may have seen the headlines published around New Year’s Day.

Mobile banking, it was reported, "has already eclipsed physical branches in terms of the percentage of U.S. customers using it to take care of their weekly banking needs."

The news, pulled from a Javelin Strategy & Research report, was not truly surprising. Mobile banking, like everything else on mobile, has been growing. And the pace of branch closings has been pretty steady.

This tipping-point story, however, raises some questions that are more interesting for those of us following closely. Questions like: What is driving mobile banking growth? Can banks and credit unions stimulate even faster growth among their customers? What will come next?

By Brad Powell

As we launch into 2016, I wanted to share the five most popular Axiaware blog posts from 2015.

The posts touched on a variety of subjects that I believe are critical for credit unions and banks today.

If you found any or all of them interesting, I encourage you to share them with colleagues and your social media networks: LinkedIn, Twitter, Facebook, whatever.

Here's the Axiaware Top 5, with a short description for each one:

5. Three Smart Tips for Credit Unions Looking to Attract Millennial Members

How can credit unions add millennial members? Start by keeping your old name, making it easy and managing your online presence.

4. Mobile Auto Lending: Credit Unions' Next Big Opportunity?

Mobile banking is growing rapidly. So are automotive loan applications. What happens when you put these two trends together?