By Brad Powell

By Brad PowellIn the banking and financial service space, biometric authentication is quickly becoming the principal form of mobile authentication. Instead of requiring a password, more and more apps use physical or behavioral characteristics to allow customers to access and manage their money.

Your first response might be: “I already knew that. The big banks have been doing this for a few years now!” Indeed. Biometrics have been around for more than a year at some larger providers, but the rate of change is fairly rapid.

Before we address what’s next, let’s quickly summarize where biometric authentication has been.

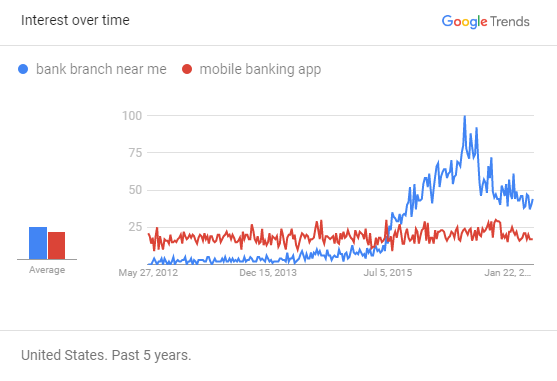

Out of curiosity, I compared two search terms on Google Trends recently: “mobile banking app” and “bank branch near me.”

It’s been widely reported that banking on mobile is overtaking branch visits in popularity. So trends in search should reflect that, right? Here’s what Google Trends showed for the past five years:

By Brad Powell

When Facebook announced it was opening its Messenger platform for third-party chatbots in April, a flood of technology and business coverage followed, hypothesizing about what the move could mean for a variety of industries.

Banking was not immune – a Google News search on "banking and bots" continues to turn up a long list of recent articles and blog posts about artificial intelligence-powered chatbots and their potential uses for banks, credit unions and other branches of the financial industry.

Often opening with the detail that Bank of America is planning to develop a bot to interact with customers in Facebook’s mobile messaging app, many of these articles sound similar notes. But a few outlets made points that were more original and intriguing. I wanted to highlight those in this post and add a couple ideas of my own regarding banking and bots.

But first, it’s worth going over the points that most of these articles have in common – the material that makes up the conventional wisdom on the topic.

By Brad Powell

You may have seen the headlines published around New Year’s Day.

Mobile banking, it was reported, "has already eclipsed physical branches in terms of the percentage of U.S. customers using it to take care of their weekly banking needs."

The news, pulled from a Javelin Strategy & Research report, was not truly surprising. Mobile banking, like everything else on mobile, has been growing. And the pace of branch closings has been pretty steady.

This tipping-point story, however, raises some questions that are more interesting for those of us following closely. Questions like: What is driving mobile banking growth? Can banks and credit unions stimulate even faster growth among their customers? What will come next?

By Brad Powell

I’ve spent some time this past year writing about the rise of mobile banking services and what it means for credit unions and banks. Whether it’s Apple Pay, opportunities with auto loans or the emergent alternative lending industry, it’s apparent that financial institutions will be spending more time devising mobile solutions in 2016 and beyond.

It’s an area that changes quickly. So I try to keep up with the news.

Today’s post rounds up three articles I read over the last several days that contained insights about the state of mobile banking at the end of 2015. I encourage you to click through and give them a read, and let me know what you think on Twitter, or in a LinkedIn Group such as Credit Union Insight, Credit Union Times or Bank Innovation. I will definitely respond!

By Brad Powell

I recently wrote a post looking at the relatively new phenomenon of alternative lending. Today's post looks at how banks are responding as alternative lenders start to see success.

In a recent survey, just seven percent of banks said they felt alternative lenders posed the greatest threat to their business. But that doesn't mean some traditional lenders aren't responding.

The responses banks and credit unions have come up with fall into two broad categories: competing with alternative lenders head-on, and investing in them.

And some traditional lenders are doing nothing. So far.

By Brad Powell

By Brad PowellAre you paying attention to all the media coverage devoted to alternative lending?

It's tempting to dismiss, I'll admit. The media seems to identify an "Uber for [fill-in-the-blank]" every week, in nearly every industry. "Alternative lending" sounds as much like a buzzword as an actual factor in the financial industry.

But alternative lending is more than a buzzword. Much more. It may account for a small segment of the U.S. lending market today, but its growth is worth noting – and it offers many lessons to banks and credit unions.

By Brad Powell

By Brad Powell

By Brad Powell

Leaders at banks and credit unions that have not adopted electronic signatures are feeling the pressure.

Maybe the pressure is coming from customers and members. Remember when your neighbor said they would NEVER shop online? Now Amazon boxes arrive at least three times per week. By now bank customers and credit union members are comfortable conducting any and all sorts of business online, so they want to manage their finances via desktop, mobile phone or tablet – or all three – as well.

Or maybe the pressure is coming from their managers, who imagine the efficiencies and risk reduction that electronic signatures could produce.

Or it could be pressure from vendors who aggressively pitch their electronic signature solution – and tell you, “It’s easy.”

In response, I have two words: Slow down.

By Brad Powell

By Brad PowellHow do I give my members the experience they want, on the devices they want to use, both now and in the future? That's a question we hear a lot. Terence Roche wrote a blog post for GonzoBanker recently that addressed that question:

Do We Need Better System Integration or Fewer Systems to Integrate?

You should read the post ─ Mr. Roche offers some great insight. And, at the risk of oversimplifying, his answer boils down to "less is more." Taking a cue from other industries and the mass adoption of mobile devices, he writes that wherever possible, banks and credit unions should move to a single system and single interface, so there are fewer interfaces and less integration.

I agree with much of his piece. And I'd like to describe a slightly different alternative to his "single-system" proposal; one that I believe will prepare a financial institution for the future. In the future, credit union members will likely have a new set of expectations, based on the technologies they'll be using at that time. Those technologies might be smart watches, or breakthrough features in mobile apps, or some device that simply doesn't exist yet.